In the ever-evolving real estate market, accurately determining property values is a complex challenge. Traditional valuation methods often fall short in capturing the nuanced and dynamic nature of real estate. This is where advanced machine learning techniques, like Self-Organizing Maps (SOM), come into play. SOMs provide a sophisticated approach to visualizing and analyzing complex data, making them particularly suitable for real estate valuation.

What are Self-Organizing Maps?

Self-Organizing Maps, introduced by Teuvo Kohonen, are a type of artificial neural network trained using unsupervised learning to produce a low-dimensional, discretized representation of the input space (Kohonen, 2001). They are widely used for clustering, visualization, and abstraction of high-dimensional data.

“Self-Organizing Maps (SOM) are a type of artificial neural network that are trained using unsupervised learning to produce a low-dimensional representation of the input space.” (Kohonen, 2001)

Application of SOM in Real Estate

In real estate, SOMs can handle large, spatially distributed datasets, uncover hidden patterns, and provide valuable insights for property valuation (Hagenauer & Helbich, 2022). For instance, SOMs can cluster properties based on characteristics such as location, size, and age, helping to identify trends and outliers in the market.

“Self-Organizing Maps are particularly useful in real estate valuation for their ability to handle large, spatially distributed datasets and reveal underlying patterns.” — Hagenauer, J., and Helbich, M. (2022).

Introducing SOMantic: Revolutionizing Real Estate Valuation in Germany

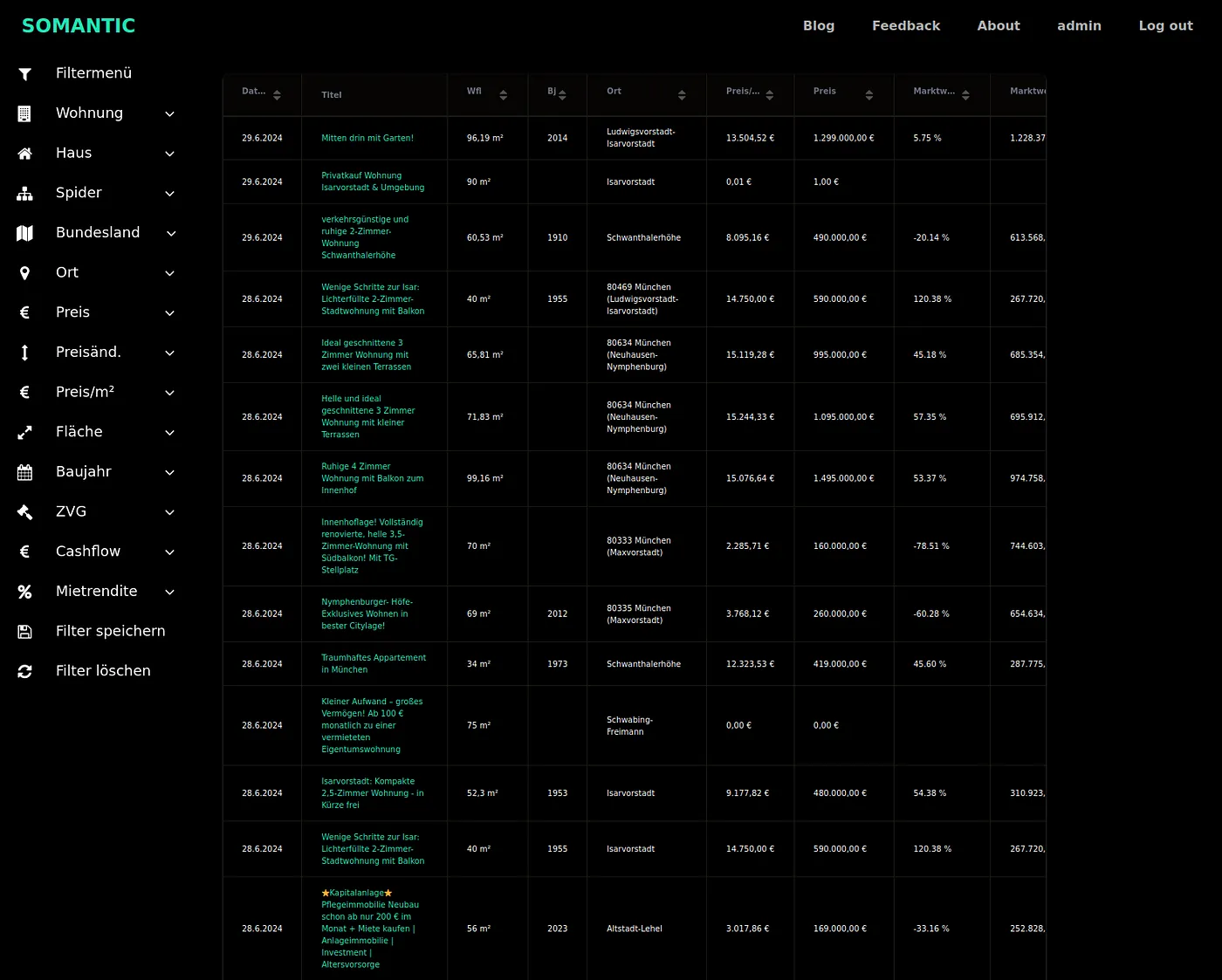

To leverage the power of SOMs, we (Kretronik GmbH) developed SOMantic, a free real estate crawler and aggregator designed to streamline property search and valuation in Germany. Somantic aggregates listings from all major real estate platforms, providing users with a single, comprehensive platform to find properties. Users can save their filters and receive real-time notifications via Telegram and/or email when new properties matching their criteria are listed, giving them a competitive edge in contacting sellers first.

How Somantic uses SOM for Property Valuation

Somantic employs SOMs to calculate the Return on Investment (ROI) and cash flow of properties by modeling their price and rent. The process involves the following steps:

-

Data Aggregation: Somantic crawls and aggregates data from various real estate platforms in Germany.

-

Feature Extraction: Key features such as latitude, longitude, square meters, room count, and age of the property are extracted.

-

SOM Training: These features are used to train the SOM, which clusters similar properties together.

-

Price and Rent Modeling: For a given property, Somantic identifies the best matching unit (BMU) within the SOM. The average price and rent of properties in this BMU are calculated to estimate the market value.

“The Self-Organizing Map (SOM) algorithm offers a unique approach to visualizing high-dimensional data through its topology-preserving mapping.” (Kohonen, 2013)

By using similar properties in a node for valuation, Somantic ensures that the estimated price and rent are reflective of the current market conditions.

Property Valuation in Munich use case

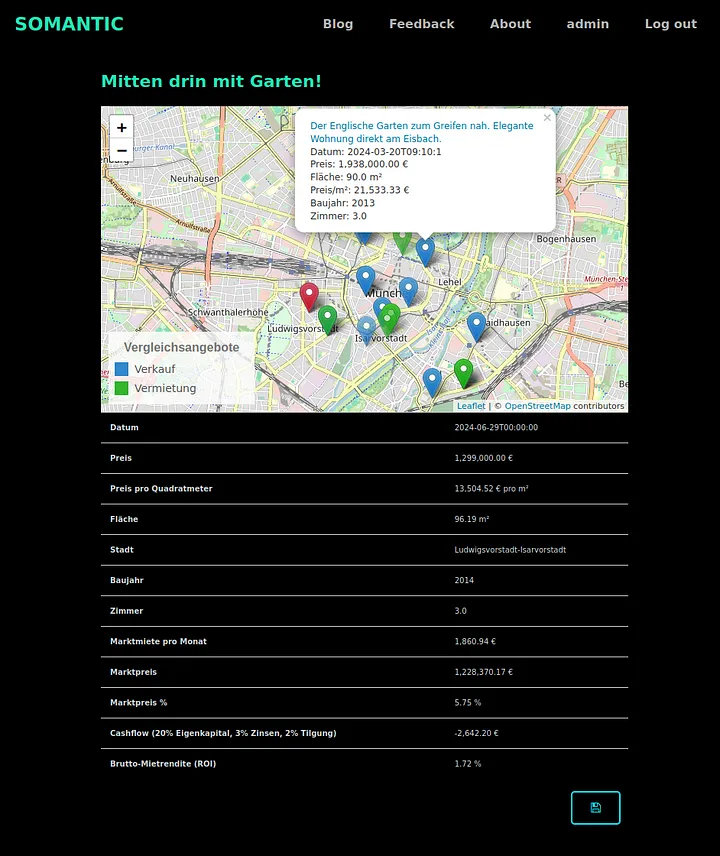

In the screenshot below we can analyze the market value and the ROI for a 96.19m² property in Munich. We also can see similar rent and sell properties on a map which can support us in our decision making.

For investors the most important metrics are cash flow and the ROI of the property. The ROI is calculated by dividing the estimated yearly rent by the price of the property. In this case we assume our rent income per year is 22.331,28 € (= 1.860,94€ * 12 which is estimated by the SOM) and divide it by the actual price of 1.299.000 € so that we get 1,72% (22.331,28 €/1.299.000 €). To be profitable the rule of thumb is to have at least 5% which in this case makes the property a bad investment and thus can quickly be filtered out.

What about the cash flow?

To calculate the cash flow we are making three assumption which can be modified by the user:

- Equity: How much of the price can I pay myself plus the closing costs? In Germany when applying for a loan with a bank it is common to pay the closing costs out of your own pocket. Here we assume we paid the closing costs + 20% of the price (259.800 €). That means we need to borrow “only” 1.039.200 € from the bank.

- Interest Rate: The current interest rates in Germany are still rising but here we assume 3% for long term contracts.

- Repayment Rate: For the repayment rate we assume the normal 2% rate.

That means if we borrow 1.039.200 € we need to pay the bank 51.960 € (=1.039.200 € * 5%) per year or 4.330 € / month. There is also the cost of the maintenance price of which 40% the owner pays and 60% the renter which for a 96.19m² apartment would be around 173,14 € (=96.19m²4,5€40%) per month. The maintenance cost for an apartment is always something in between 3€ — 4,5€ per square meter. That leads us to a cash flow of -2642,20€ (=1860,94€-4.330€-173,14€) which is negative. We should only buy properties with positive cash flow that means we should adjust our parameters (increase our equity percentage), negotiate a smaller price or search for another profitable apartment.

Advantages of Using SOMantic

- Comprehensive Aggregation: Access all real estate listings in Germany on one platform.

- Real-Time Notifications: Stay ahead with instant updates on new listings.

- Accurate Valuation: Benefit from advanced SOM-based models for precise property valuation.

- Investment Insights: Calculate ROI and cash flow to make informed investment decisions.

The integration of Self-Organizing Maps through SOMantic in real estate valuation should add transparency to the industry and simplify fast decision making. By leveraging SOMs, Somantic not only aggregates listings but also offers precise valuation and investment analysis, making it a useful tool for buyers and sellers.

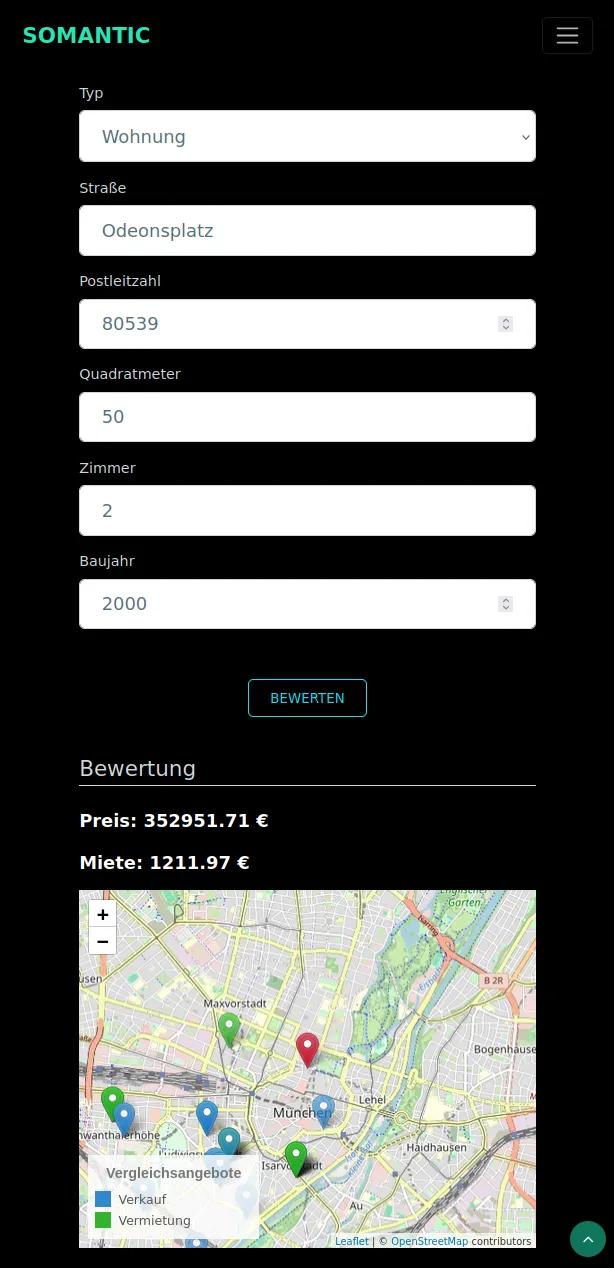

For more information, visit Somantic and explore how it can transform your real estate experience. Try out the free price and rent estimation yourself:

Developers can also use our estimate and data APIs.

References:

- Kohonen, T. (2001). Self-Organizing Maps.

- Nguyen, T. V., & Cripps, A. (2001). Predicting Housing Value: A Comparison of Multiple Regression Analysis and Artificial Neural Networks. Journal of Real Estate Research, 22(3), 313–336.

- Kohonen, T. (2013). Essentials of the Self-Organizing Map. Neural Networks, 37, 52–65.

- Hagenauer, J., & Helbich, M. (2022). A Comparative Study of Machine Learning Classifiers for Modeling Spatial Data. ISPRS International Journal of Geo-Information, 11(1), 1–26.

- Bação, F., Lobo, V., & Painho, M. (2005). The Self-Organizing Map, the Geo-SOM, and relevant variants for geosciences. Computers & Geosciences, 31(2), 155–163.

- Kohonen, T. (1995). Self-Organizing Maps and their Applications. Neural Networks, 8(3), 477–493.

- Hamnett, C. (1991). The Blind Men and the Elephant: The Explanation of Gentrification. Transactions of the Institute of British Geographers, 16(2), 173–189.